Understanding the procure-to-pay process, processes and systems is significant if you run traditional business or even a digital one. Your accounts payable team should be able to validate and check the nature and status of a transaction at any given point, from the time a product or service is ordered until the time the invoice for it has been paid. In this blog, we’re going to explore the procure-to-pay process - what it stands for, as well as the benefits and process of utilizing the right procure-to-pay process.

Let’s first understand what is the procure-to-pay process

The procure-to-pay process is the coordinated and integrated action taken to fulfill a requirement for goods or services on time at a reasonable price. It comprises a series of steps which range from the need identification to invoice approval and actual vendor payment. These steps have to be exercised in a structured manner.

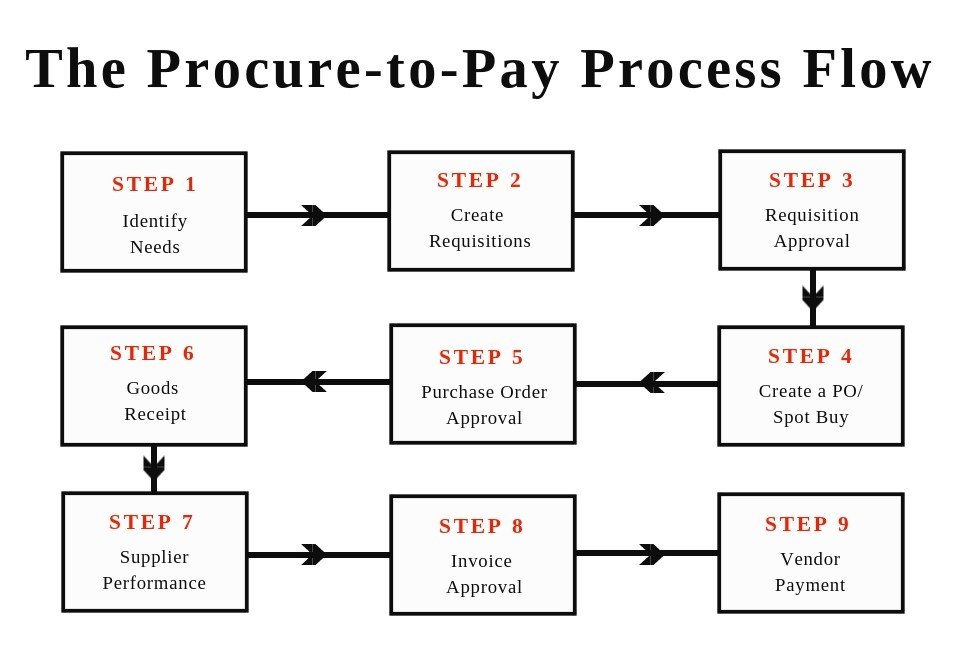

The Procure-to-Pay Process

Varying from industries and individual organizational practice and requirements the procurement team can opt for the most relevant stages of a procure-to-pay process. We have mapped 9 sequential stages of an ideal procure-to-pay process.

Step 1: Identify the requirements and needs

The first step of a procure-to-pay process is to identify and map the business requirements with the help of cross-functional teams & stakeholders. Once a valid requirement & need is identified, procurement teams map out high-level specifications for goods/products and terms of reference (TOR) for services and statements of work (SOW).

Step 2: Create requisitions

After finalizing the specifications/TOR/SOW, a formal purchase requisition is developed. A requester submits the filled-out purchase requisition form after making sure that all necessary administrative requirements are met. Requisitions can be created for any procurement, from standard purchases to subcontracts and consignments.

Step 3: Purchase requisition approval

Department heads or procurement officers then go through and review submitted purchase requisitions. Approvers can either approve or reject a purchase requisition after evaluating the need, verifying the available budget, and validating the purchase requisition form. Incomplete purchase requisitions are rejected back to the initiator for correction and resubmission.

Step 4: Create a PO/spot buy

Incase the requested goods/products have characteristics such as unmanaged category buys, unique one-time purchases, or low-value commodities. In such a case, a spot buy can be performed. Else, purchase orders are created from approved purchase requisitions.

Step 5: Purchase order approval

Purchase orders are now sent through an approval loop to ensure the legitimacy and accuracy of specifications. Approved purchase orders are then dispatched to vendors. After reviewing the purchase order, vendors can either approve, reject, or start a negotiation. When an officer approves a purchase order, a legally binding contract is activated.

Step 6: Goods receipt

Based on the data obtained from the previous step, the supplier performance is evaluated. Several factors like quality, on-time delivery, service, contract compliance, responsiveness, and Total Cost of Ownership (TCO). Non-performance is flagged in existing rosters and information systems for future reference.

Step 7: Supplier performance

Based on the data obtained from the previous step, the supplier performance is evaluated. Several factors like quality, on-time delivery, service, contract compliance, responsiveness, and Total Cost of Ownership (TCO). Non-performance is flagged in existing rosters and information systems for future reference.

Step 8: Invoice approval

Once a goods receipt is approved, a three-way match between the purchase order, the vendor invoice, and the goods receipt are performed. If there are no discrepancies found, the invoice is approved and forwarded to the finance team for payment disbursement. In the case of inaccuracies, the invoice is rejected back to the vendor with a reason for rejection.

Step 9: Vendor payment

Upon receiving an approved invoice, the finance team will process payments according to the contract terms. Any contract changes or reviews of liquidated financial security will be taken into account. A payment made to a supplier will fall into one of the following five types: advance, partial, progress or installment, final, and holdback/retention payments.

The Challenges in Procure-to-Pay Process

Lack of Speed in Invoice Processing

Manual operations, processing and routing lead to high turn around time for approvals and considerably reduce the speed in the P2P cycle leading to penalties and damaging of client relationships.

High Risk of Error

Wherever there is a manual and paper-based process involved the inherent risk of error increases. It impacts the working capital as the transactions are subject to the scrutiny for regulatory audits and compliance.

High Costs Per Invoice

The average cost per invoice increases due to an increase in attention to diagnosing the processing errors and subsequent error resolutions.

Low Spend Visibility

Visibility is essential in a procure-to-pay process from having a quick access to information of whether the invoice has been received, processed, or paid brings a level of stability, control, and oversight that is absent in a manual system.

Inefficient Processes

There are various departments in a large organization managing various aspects of the procure-to-pay process. Each department optimizes their processes for their function sometimes without considering the overall process leading to inefficient processes altogether.

Lack of Governance and Compliance

Generally speaking, governance and compliance of procurement processes tend to be inflexible. The key principle of spend pre approval is often viewed as unwanted bureaucracy, which results in non-contracted spending and ad-hoc purchases.

Managing Changes

Management often sees procurement processes as non-critical to business operations, which means that upgrading technology and improving processes are often a low priority, if on the radar at all.

Solutions to Address Common Challenges in Procure to Pay Process Flow

Outsource and Hire Experts

A reliable service provider allows the company to focus more on high-value activities to add value to the organization while enabling the accounts payable department to be more productive and reduce costs. And perhaps most importantly, it goes a great way in improving supplier relationships throughout the supply chain because it increases timely payment. You’ll no longer have to worry about late payment fees. And it’s best to have experts handle your p2p process while you focus on big picture thinking.

Use Technology and Automation

Securing Data is a main concern for any organization. With trusted partners and cloud technology data and processes can be standardized, systemized and secure helping an organization have high efficiency and high impact at reasonable costs.

Simplify your procure-to-pay process with KGMC India today! Get in touch with us to know more.